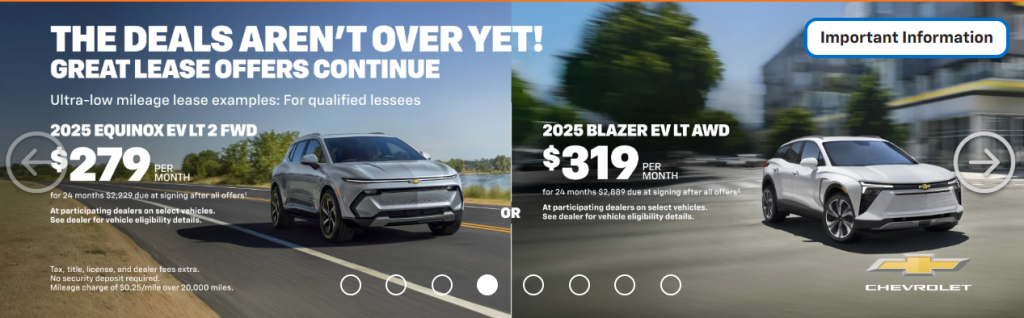

If you’re in the market for a new ride, now’s a great time to check out the lease deals at Burien Chevrolet. They’re offering some compelling lease specials—like the 2026 Chevrolet Equinox EV for $279/month + tax for 24 months. That kind of monthly payment gets you into a brand-new vehicle with less long-term commitment than buying. In this blog post, we’ll highlight the key lease offers and then walk through the major advantages of leasing versus buying so you can decide what’s right for your driving style and finances.

Highlighted Lease Offers at Burien Chevrolet

- The 2026 Equinox EV: As noted above, $279/month + tax for 24 months for qualified lessees.

- The 2026 Chevrolet Trailblazer RS: Starting at $421/month for 36 months with $5,000 down (10,000 miles/year assumption).

- The 2025 Chevrolet Traverse LT: $634/month for 48 months with $5,000 down (10k miles/year).

These offers give you a “window” into how leasing can reduce your monthly outlay compared to what you might pay to finance and own that same vehicle. (Of course, your actual payment will depend on credit, down payment, mileage allowance, and other terms.)

Why Lease Instead of Buy?

Leasing isn’t right for everyone, but it offers several advantages worth considering—especially if you value flexibility and newer vehicles.

1. Lower Monthly Payments

Because a lease covers the vehicle’s depreciation over the term (rather than the full purchase price), your monthly payment tends to be lower compared to buying. For example: when Burien Chevrolet lists $421/month for 36 months on the Trailblazer RS, that’s only part of the cost of the vehicle (with $5,000 down). If you bought the same car, you’d likely pay much more per month (or have a longer term) because you’d be financing the full purchase price.

2. Drive Newer Cars More Often

Leases typically last 2–4 years. At the end of that term, you can return the vehicle and lease or buy a new one. If you like driving the latest technology (safety features, infotainment, EVs, etc.), leasing gives you that ability without getting “stuck” with an older car. Just look at the Equinox EV lease—it’s a newer model (2026) and you only commit to 24 months.

3. Potentially Lower Repair Risk

Because you’re driving newer vehicles under warranty, major mechanical issues are less likely—and many maintenance costs may still be covered by the manufacturer or by the included warranty. If you lease through a dealer like Burien Chevy, you’re often looking at a vehicle that’s still in its “sweet spot” for reliability.

4. Flexibility at Lease End

At the end of the lease you typically have options:

- Return the car and walk away (assuming you’ve met all terms: mileage, wear/tear)

- Purchase the vehicle for the residual value

- Lease or purchase a new vehicle.

This flexibility can be a big plus if you’re unsure how long you want to keep a given vehicle.

5. Take Advantage of Strong Specials

Dealerships often offer lease-specials with incentives built in. As shown in the Equinox EV offer, there are manufacturer incentives and specific terms (10,000 miles/year, etc.) that make the deal more attractive. By shopping the specials at Burien Chevrolet, you might get more favorable terms than typical buying incentives.

Things to Watch & Consider Before Leasing

Leasing is not without caveats. Here are some important things to keep in mind:

- Mileage limits: Most leases (including those at Burien Chevrolet) assume a certain mileage per year (often 10,000 miles) and impose penalties for excess miles.

- Wear-and-tear charges: When you return the vehicle you’ll be responsible for “excessive” wear or damage.

- No ownership equity (unless you purchase): Leasing means you don’t automatically own the vehicle when the term ends—unless you choose the buy-out option.

- Termination/early exit fees: If you end a lease early it’s often costly.

- Customization restrictions: Leases often limit modifications to the vehicle.

- Residual value risk: Leasing depends on predicted residual value. If that estimation is off, your lease terms may be less favorable (though dealers typically absorb that risk ahead of time).

- Down payment and up-front costs: Even though monthly payments are lower, you may still have a down payment, upfront fees or deposit. For instance, the Trailblazer lease needs $5,000 down.

Is Leasing Right for You?

Here are some questions to help determine if leasing at Burien Chevrolet might be a good fit:

- Do you change vehicles every 2–4 years and like driving the newest model? Then leasing fits well.

- Do you drive moderate miles (e.g., under the mileage limit in the lease)? If you commute long distances or use the vehicle heavily, the mileage penalties may add up.

- Do you prefer lower monthly payments and don’t mind returning the vehicle rather than owning it long term?

- Are you comfortable with the idea that you’ll have another transaction (new lease or purchase) in a few years rather than just “owning” for a long time?

- Do you like reducing the risk of major repair costs (because newer vehicles under warranty reduce some of that risk)?

If you answered “yes” to most of the above, leasing at Burien Chevrolet might make strong financial and lifestyle sense.

If you’re considering leasing your next vehicle, the offers at Burien Chevrolet provide great opportunities. Stop by and talk to one of our knowledgeable staff today!